Market Insights: Earnings & Revenue Growth Propelling Markets

Milestone Wealth Management Ltd. - Oct 24, 2025

Macroeconomic and Market Developments:

- North American markets were up this week. In Canada, the S&P/TSX Composite Index closed 0.81% higher. In the U.S., the Dow Jones Industrial Average rose 2.20% and the S&P 500 Index increased 1.92%.

- The Canadian dollar rose slightly this week, closing at 71.40 cents vs 71.30 cents USD last week.

- Oil prices rose 6.8% this week, with U.S. West Texas crude closing at US$61.47 vs US$57.57 last week.

- The price of gold ended its run this week falling almost 3%, closing at US$4,118 vs US$4,241 last week.

- U.S. inflation eased slightly in September, with the Consumer Price Index rising 0.3% for the month and 3.0% year-over-year, both below expectations. Core CPI, which excludes food and energy, climbed just 0.2%, marking continued disinflation momentum. The main price drivers were energy (+1.5%), led by a 4.1% jump in gasoline, while housing rents rose only 0.1% — the smallest gain since 2021. Apparel and airfares also increased, offset by declines in used cars and auto insurance. Despite elevated year-over-year figures, slowing money supply growth and a softening labor market point toward lower inflation and slower growth ahead, supporting the case for another Fed rate cut next month.

- Canada’s annual inflation rate rose to 2.4% in September, up from 1.9% in August and slightly above expectations, complicating the outlook for the Bank of Canada’s Oct. 29 rate decision. The jump was driven by higher gasoline, travel, and grocery prices, with food costs up 4% year-over-year. Core inflation remained above 3%, showing limited progress toward the BoC’s target. While some economists said the stronger print could delay the next rate cut, others, including CIBC and RBC, argued that weak confidence, a soft labour market, and easing tariff pressures still support another 25-bps reduction. Markets now place odds of a rate cut at 86%, as policymakers weigh modest inflation persistence against sluggish growth.

- The U.S. and Australia signed an $8.5 billion critical minerals deal at the White House to strengthen supply chains and reduce reliance on China’s rare earth exports. The agreement, announced by President Donald Trump and Prime Minister Anthony Albanese, commits over $3 billion in joint investment within six months to develop projects for key resources like lithium, cobalt, and nickel. It comes after Beijing imposed new export restrictions on rare earths, prompting Washington to deepen alliances across the Indo-Pacific. Officials called the deal a major step toward “de-risking” global supply chains.

- President Donald Trump will meet Chinese President Xi Jinping on Oct. 30 during the APEC Summit in South Korea — their first in-person meeting since 2019 — as the two leaders seek to de-escalate tensions and revive stalled trade talks. The meeting follows weeks of tariff threats, tech export restrictions, and China’s new curbs on rare earth minerals, all of which have reignited trade war concerns. Analysts call it a “high-risk, high-reward” summit, with potential for a reset but little expectation of sweeping breakthroughs. Both sides are expected to discuss tariffs, agricultural trade, fentanyl, rare earths, and Taiwan, with Washington signaling openness to easing tech curbs if Beijing commits to greater cooperation. Markets view the talks as a key step toward restoring calm ahead of the Nov. 10 expiration of the current trade truce.

- President Donald Trump abruptly ended trade negotiations with Canada, accusing Ottawa of producing a “fake” $75 million ad featuring edited audio of Ronald Reagan criticizing tariffs without authorization. The Ronald Reagan Presidential Foundation confirmed Ontario’s government created the ad using “selective audio” from a 1987 radio address and said it’s considering legal action. Calling the move “egregious,” Trump declared “all trade negotiations with Canada are hereby terminated,” asserting that tariffs are essential to U.S. economic and national security interests. The dispute marks a sharp escalation in tensions just weeks after the two countries began discussing tariff relief.

Weekly Diversion:

Check out this video: More of this tonight... Go Jays!

Charts of the Week:

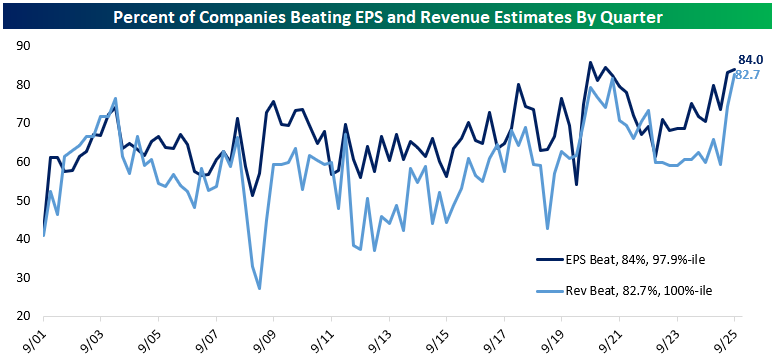

The current third quarter reporting period in the U.S. has demonstrated exceptional corporate performance, particularly in terms of top-line growth. A significant majority of U.S. companies have exceeded revenue expectations, marking one of the strongest showings in over two decades. Earnings per share (EPS) results have also been robust, ranking among the top historical performances. This outperformance is notable given the inherent unpredictability of sales trends compared to cost management, suggesting broad-based demand resilience across sectors.

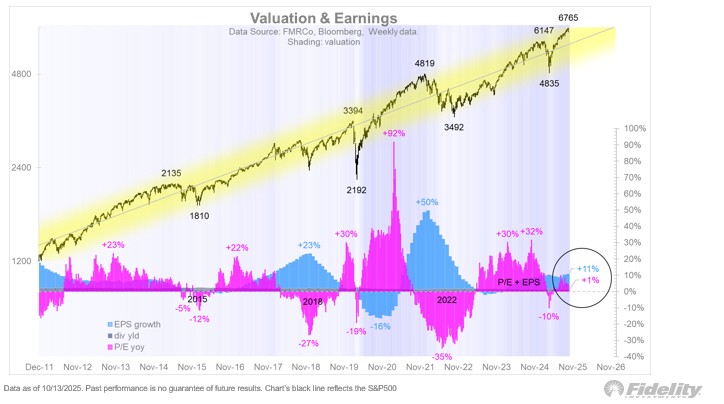

As highlighted in the first chart of the 156 companies in the U.S. that have reported so far, EPS and revenue beat rates hit 84% (97.9th percentile) and 82.7% (100th percentile), respectively. Furthermore, and perhaps just as important to the direction of stock prices, the second chart shows that the recent increase of the S&P 500 (black line) over the last six months has been primarily driven by EPS growth, represented by the blue bars, at 11% compared to year-over-year price-to-earnings ratio (P/E) growth, represented by the pink bars, at 1%.

Source: Bespoke Investment Group

Source: Jurrien Timmer, Fidelity – Information as of 10/13/2025

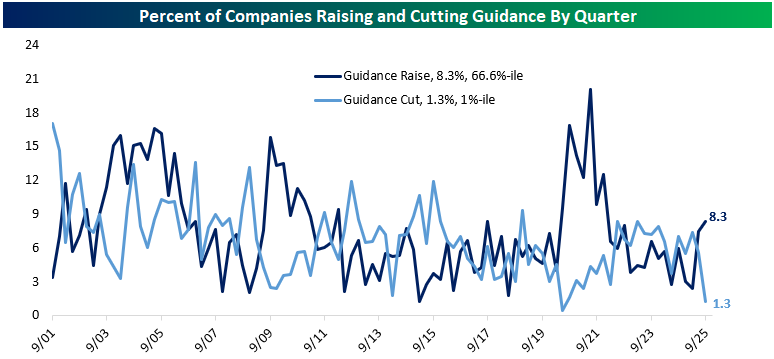

Corporate guidance has further reinforced confidence, with a notably low percentage of firms (just 1.3% - 1st percentile historically) revising their outlooks downward—a rare occurrence that underscores strong forward-looking sentiment, as shown in the last chart. Collectively, these indicators reflect a corporate landscape navigating challenges effectively while capitalizing on growth opportunities, contributing to a highly favorable financial environment at this stage of the cycle.

Source: Bespoke Investment Group

Sources: Yahoo Finance, First Trust, The Canadian Press, ABC, CNBC, Fox Business, Bespoke Investment Group, Jurrien Timmer - Fidelity

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.