Market Insights: October Volatility and Opportunity

Milestone Wealth Management Ltd. - Oct 17, 2025

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index closed 0.53% lower. In the U.S., the Dow Jones Industrial Average rose 1.56% and the S&P 500 Index increased 1.70%.

- The Canadian dollar inched lower this week, closing at 71.30 cents vs 71.41 cents USD last week.

- Oil prices were down this week, with U.S. West Texas crude closing at US$57.57 vs US$58.81 last week.

- The price of gold rose again this week, closing at yet another all-time high US$4,241 vs US$4,030 last week.

- President Donald Trump said the current 157% tariffs on Chinese imports are “not sustainable,” acknowledging they were imposed only after Beijing tightened controls on rare earth exports critical to U.S. industries. Speaking ahead of his planned meeting with President Xi in South Korea, Trump said China had “forced” his hand but expressed optimism that the two sides could reach a fair-trade deal, emphasizing his “strong relationship” with Xi despite escalating tensions.

- Ontario Premier Doug Ford warned that Canada could cut off exports of uranium, potash, and critical minerals if President Trump continues to target Canada with tariffs, saying the U.S. is “desperate” for Canadian resources. At the Toronto Global Forum, Ford underscored U.S. dependence on Canadian uranium—used in 94 U.S. nuclear turbines—as well as potash and key battery metals like nickel and cobalt. While Ford urged a faster federal response, Carney maintained that now is “a time to talk, not hit back” as Ottawa seeks to de-escalate the trade dispute.

- Automakers warned that a chip supply disruption at Chinese-owned Nexperia could quickly halt U.S. vehicle production, following the Dutch government’s takeover of the semiconductor firm over national security concerns. Nexperia, now restricted from exporting key components by China, supplies essential chips to globally. The Alliance for Automotive Innovation—representing GM, Ford, Toyota, Volkswagen, and others—urged a rapid resolution, warning that shutdowns could begin as early as next month. The move deepens geopolitical tensions after the Netherlands cited risks of technology transfer to Nexperia’s Chinese parent, Wingtech, which is already on the U.S. entity list, underscoring how chip politics can threaten global supply chains.

- Scotiabank has begun layoffs across its Canadian banking division as part of its ongoing multiyear turnaround and cost-efficiency strategy, aimed at accelerating growth in core clients and streamlining operations. The restructuring follows the bank’s 2023 strategic refresh under CEO Scott Thomson, which shifted focus toward North American markets and digital investment. While the number of job cuts wasn’t disclosed, executives said the move will help “build a more profitable Canadian bank” by improving collaboration, eliminating low-value activities, and investing in higher-impact initiatives. Scotiabank’s latest quarter beat profit expectations, with ROE improving to 12.4%, signaling early progress despite continued caution on the outlook.

- The Edmonton Chamber of Commerce warned that Alberta’s province-wide teachers strike, now in its ninth school day, is hurting local businesses as employees stay home to care for children and foot traffic declines. Chamber president Doug Griffiths urged a quick resolution, noting the strike’s broad economic impact on workers and small firms. The walkout, involving 51,000 teachers and 740,000 students, began Oct. 6 over disputes around wages, classroom sizes, and support resources. The government has hinted it may legislate teachers back to work if the impasse continues into late October.

Weekly Diversion:

Check out this video: Mad Max refuses to leave the mound

Charts of the Week:

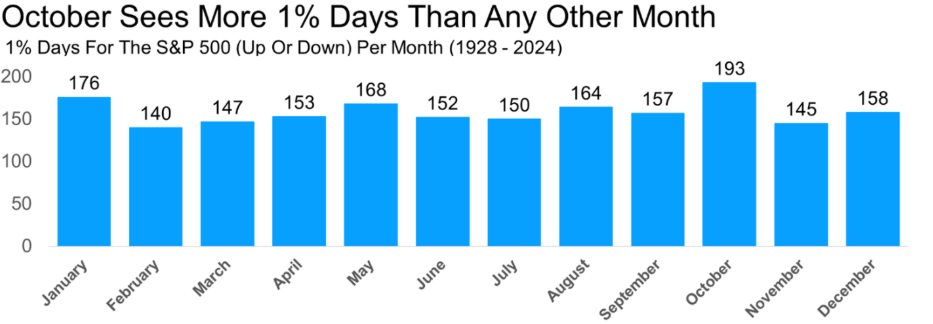

Market activity in October often serves as a catalyst for volatility, especially after prolonged periods of relative market calm. Historical patterns show that this month consistently produces more significant daily market moves than any other, making it a pivotal period for both risk and opportunity. The chart below demonstrates this by showing the number of 1% change days by month from 1928 to 2024, with October far outpacing all other months. This heightened activity reflects not only seasonal investor behaviors but also the market's responsiveness to evolving economic data and earnings reports.

Source: Carson Investment Research, FactSet, @ryandetrick

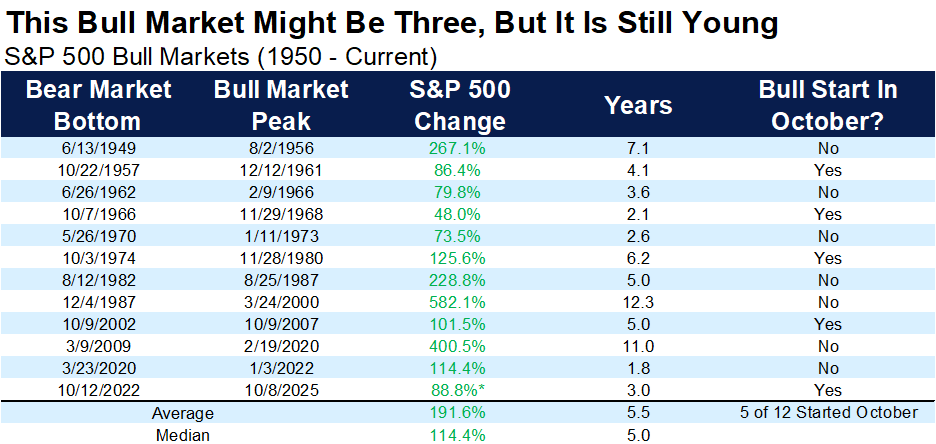

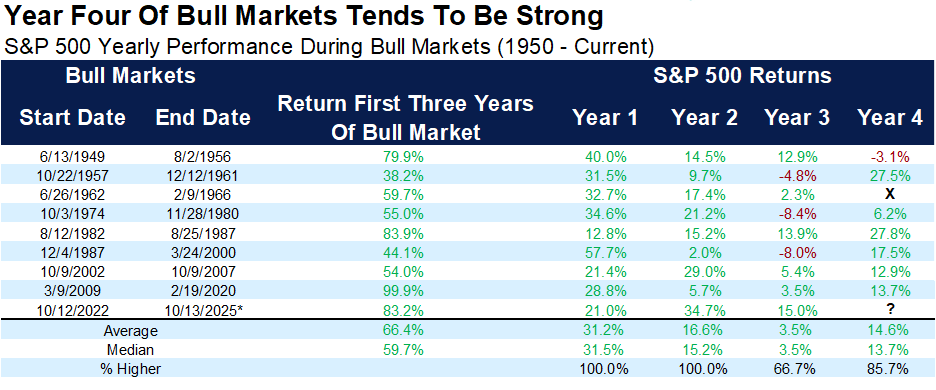

October's reputation as a "bear market killer" is supported by its role in marking the beginnings of several bull markets over the past decades (five of the last twelve) including the current bull market which started in October of 2022, as shown in the first chart below. Once a bull market reaches its third year, historical trends suggest it often continues with robust performance into its fourth year (now), displaying notable sector leadership and broadening participation, as the second chart highlights. We can observe 4th year average returns of 14.6% with positive returns over 85% of time. This cycle reinforces investor confidence and strategic positioning as trends shift, and new leaders emerge.

Source: Carson Investment Research, Y Charts, FactSet, @ryandetrick

Technology and communication services have demonstrated outsized gains throughout the current bull market as the last chart shows, considerably outperforming other sectors over multi-year periods. However, just in the last couple of weeks, the U.S. small-cap index as represented by the Russell 2000 finally broke out to a new all-time high, surpassing a strong resistance level built up from prior peaks of November 2021 and 2024. This is a positive development of strong underlying breadth that could extend this bull market further. As this potentially improves this year, we could see more broad-based market cap and sector performance as opposed to being narrowly isolated to large-cap tech, offering more balanced opportunities beyond those dominant tech names as we discussed a few weeks ago.

Source: FactSet, Returns based on Sector SPDR ETFs, S&P 500 proxied by SPY ETF

For investors, October’s distinct characteristics necessitate a nuanced approach focused on both managing risk and capitalizing on emerging trends. Understanding sector rotation, the sources of market returns, and the implications of historical volatility can help inform strategic asset allocation decisions. Ultimately, the month presents both caution and potential for reward, shaped by the interplay of market history, current economic forces, and corporate fundamentals.

Sources: Yahoo Finance, First Trust, The Canadian Press, The Globe & Mail, Reuters, Fox Business, Carson Investment Research, FactSet, Y Charts, @ryandetrick

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.