Market Insights: Small Caps Get a Boost

Milestone Wealth Management Ltd. - Sep 26, 2025

Macroeconomic and Market Developments:

- North American markets were narrowly in the red this week. In Canada, the S&P/TSX Composite Index closed 0.02% lower. In the U.S., the Dow Jones Industrial Average fell 0.15% and the S&P 500 Index decreased 0.31%.

- The Canadian dollar was down this week, closing at 71.74 cents vs 72.54 cents last week.

- Oil prices were up this week, with U.S. West Texas crude closing at US$65.32 vs US$62.69 USD last week.

- The price of gold rose again this week, closing at another all-time high of US$3,796 vs US$3,716 last week.

- U.S. Q2 GDP growth was revised up to 3.8% (vs. 3.3% expected), with stronger consumer spending, business investment, and government outlays offsetting softer trade, inventories, and housing; “core” GDP (consumption, business fixed investment, homebuilding) rose 2.9%, while GDP inflation ticked slightly higher to 2.1% and nominal GDP surged at a 6.0% annualized pace, though corporate profits were revised sharply lower (+0.2% Q/Q, +3.6% YoY), leaving equities still looking stretched on valuation models. Altogether a stronger, more positive picture of underlying growth heading into the second half of 2025.

- The Fed’s preferred gauge showed core PCE inflation steady at 2.9% YoY in August (+0.2% MoM), while headline PCE rose to 2.7% on a 0.3% monthly gain, all in line with expectations; stronger-than-expected income (+0.4%) and spending (+0.6%) underscored resilient consumers despite tariffs, with goods (+0.1%), services (+0.3%), and housing (+0.4%) all advancing—supporting the outlook for two more Fed cuts this year, as markets price in a likely move in October.

- President Trump signed an executive order approving the separation of TikTok’s U.S. operations from ByteDance, allowing the deal to proceed under a 2024 law banning apps controlled by foreign adversaries; the U.S. entity, led by Oracle, Silver Lake, and UAE’s MGX (45% stake), will control TikTok’s algorithm to address national security concerns, while ByteDance’s stake will fall below 20%, ensuring American investors hold majority control and keeping the platform accessible to U.S. users.

- Canada’s GDP grew 0.2% in July, rebounding after three months of contraction as mining (+1.4%), manufacturing (+0.7%), and wholesale trade (+0.6%) lifted goods-producing industries (+0.6%), while services rose a modest 0.1%; the data suggest Q3 GDP is tracking about 0.8% annualized, easing recession fears, though U.S. tariffs continue to weigh and markets see the Bank of Canada’s Oct. 29 decision as a coin toss for another 25 bps cut.

- Canada posted a C$7.79B budget deficit in the first four months of FY 2025/26, slightly wider than last year’s C$7.30B, as program spending rose 3% across major categories while revenues grew 1.6% on stronger income taxes and a 162% jump in customs duties from retaliatory U.S. tariffs; lower interest rates trimmed debt charges, and the July monthly deficit narrowed to C$1.51B vs. C$4.41B a year earlier.

Weekly Diversion:

Check out this video: Ryder Cup is Back! Bet You Can’t Make That Putt

Charts of the Week:

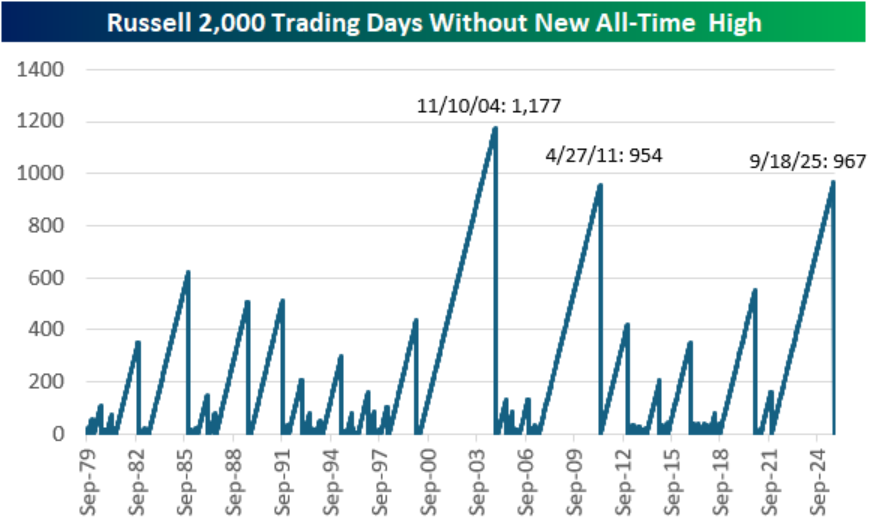

Small-cap stocks have recently achieved a significant milestone in the financial markets, reaching a new all-time high after nearly four years of lagging behind their larger counterparts. This event is noteworthy because it marks the end of a long period where small caps, alongside midcaps and transport stocks, had not kept pace with the broader bull market—a development many market participants had been awaiting as confirmation of underlying market strength. As we can see in the chart below, this was the second longest number of trading days before reaching a new all-time high since 1979, only behind the 1177 trading days that culminated in November 2004. It may be worth noting that the third longest period that ended in April of 2011 was very early days of the secular bull market that we remain in today.

Source: Bespoke Investment Group

The achievement of a new all-time high by small-cap equities is not just a statistical milestone; it is a meaningful signal of broader market participation. While the market rally in recent years has been led primarily by technology-driven large-cap stocks, the resurgence of small caps of late suggests that gains are spreading more widely across different sectors and company sizes. Broad participation in market gains is considered a healthy indicator, reducing the risk of over-concentration and suggesting that even if dominant big tech stocks falter, other market segments are poised to continue the upward momentum.

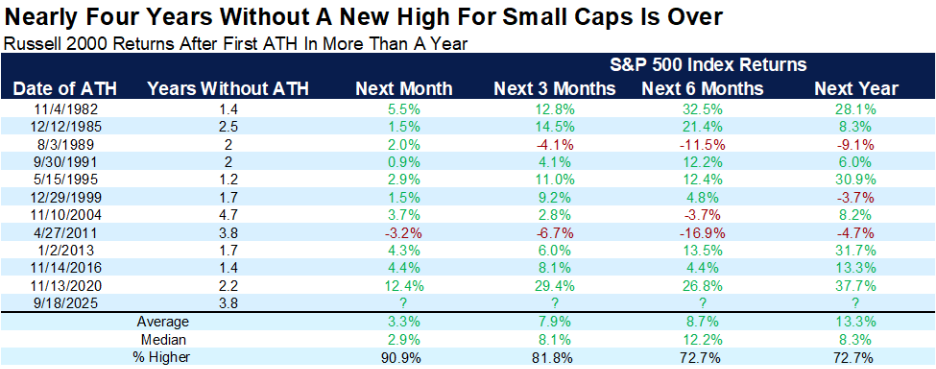

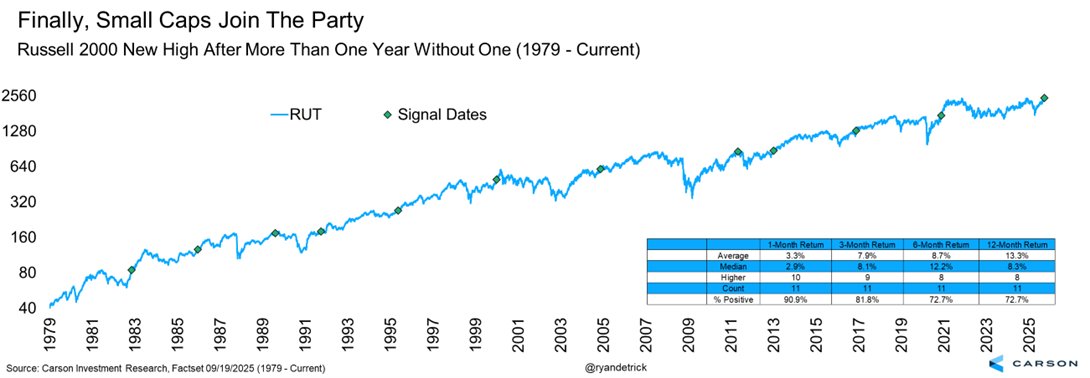

Historically, when small caps have gone a considerable time (over one year) without reaching new all-time highs and then finally break through, the subsequent market performance has often been positive and above average, as shown by the next table and chart (data points from the table highlighted by the green dots on the chart). Data shows that, after the 11 prior milestones in the last 45 years, small caps have typically delivered strong returns in the months that follow, with the index higher 90.9%, 81.8% and 72.7% of the time the next month, three months and six & twelve months, respectively. This historical precedent implies that the latest highs could foreshadow continued strength in the near- to intermediate-term for this market segment, particularly over the next three months on an annualized basis.

Source: Carson Investment Research, FactSet, @ryandetrick

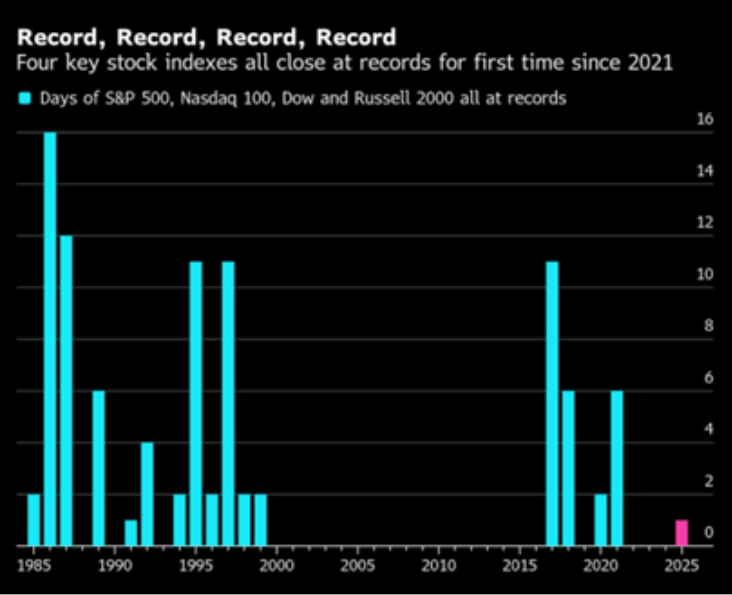

Adding further weight to this development is the very recent occurrence where all four major U.S. stock indices—the Dow Jones Industrial Average, S&P 500 Index, Nasdaq Composite, and Russell 2000 Index—all closed at record levels on the same day for the first time since 2021. Such synchronized performance across key indices is not common and typically reflects a robust, broad-based confidence in the market's trajectory. It suggests that leadership is becoming less concentrated, and more sectors are contributing to overall market gains.

Source: Bloomberg

Given past patterns and the current market environment, small-cap stocks may be positioned for additional gains in the coming months. This renewed participation hints at resilience beyond the reliance on technology and mega-cap names that have dominated headlines, ultimately pointing to a healthier, more sustainable market landscape going forward, and reinforces the broad diversification investment strategy.

Sources: Yahoo Finance, Reuters, CNBC, Fox Business, First Trust, Carson Investment Research, FactSet, @ryandetrick, Bloomberg

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.