Market Insights: S&P 500 2025 Returns Driven by Profitability

Milestone Wealth Management Ltd. - Sep 19, 2025

Macroeconomic and Market Developments:

- North American markets were up this week. In Canada, the S&P/TSX Composite Index closed 1.65% higher. In the U.S., the Dow Jones Industrial Average rose 1.05% and the S&P 500 Index increased 1.22%. All three are sitting at all-time highs.

- The Canadian dollar rose just slightly this week, closing at 72.54 cents vs 72.22 cents last week.

- Oil prices were close to flat this week, with U.S. West Texas crude closing at US$62.69 vs US$62.52 last week.

- The price of gold rose again this week, closing at another all-time high of US$3,716 vs US$3,683 last week.

- Following this week's rate cut in the U.S., new Fed Governor Stephen Miran dissented at this week’s meeting, favoring a 50 bps cut instead of 25 bps, arguing tariffs haven’t produced “material inflation” and that policy remains overly restrictive for the labor market; Miran—also Trump’s Council of Economic Advisors chair on leave—penciled in six cuts this year and hopes to persuade colleagues, while Minneapolis Fed President Kashkari also raised his rate cut forecast (to three) citing job market risks, though he stressed flexibility if inflation proves stickier than expected.

- The Bank of Canada cut its policy rate by 25 bps to 2.5%, its first move since March, citing a weaker economy, rising unemployment (+100,000 jobs lost in July–August; jobless rate at 7.1%), and easing inflation pressures (August CPI 1.9%); while Governor Macklem highlighted uncertainty from U.S. tariffs and weaker business investment, economists expect further cuts in October and December as core inflation drifts below 3% and growth remains subdued.

- Canadian retail sales fell 0.8% in July to $69.6B, with declines in eight of nine subsectors—led by supermarkets (-2.5%) and clothing retailers (-2.9%)—partially offset by a small gain in motor vehicles (+0.2%); core sales dropped 1.2%, volumes fell 0.8%, and while an advance estimate points to a rebound in August (+1.0%), economists caution that cooling jobs and wages signal a more frugal consumer ahead, aligning with the Bank of Canada’s recent rate cut to 2.5% amid mounting economic weakness.

- U.S. retail sales rose 0.6% in August (+0.8% with revisions), the third straight monthly gain and stronger than expected, with broad increases led by nonstore retailers (+2.0%), autos (+0.5%), and restaurants & bars (+0.7%); “core” sales climbed 0.7% and are tracking a 6.3% annualized pace in Q3, the fastest since 2023, showing resilient consumer spending despite a cooling labor market, though economists caution tighter monetary policy could still weigh on growth ahead.

- Cenovus Energy defended its cash-and-stock bid for MEG Energy as offering stronger value and certainty than Strathcona Resources’ rival all-stock proposal, highlighting scale, synergies, and balance sheet strength; Cenovus’ offer (72% cash/28% stock) implies $28.44 per share, a 39% premium to May levels, while MEG’s board unanimously backed it as superior to Strathcona’s bid—though Strathcona, which holds 14.2% of MEG, has vowed to vote against the deal ahead of the Oct. 9 shareholder vote.

Weekly Diversion:

Check out this video: Putting the kids to sleep

Charts of the Week:

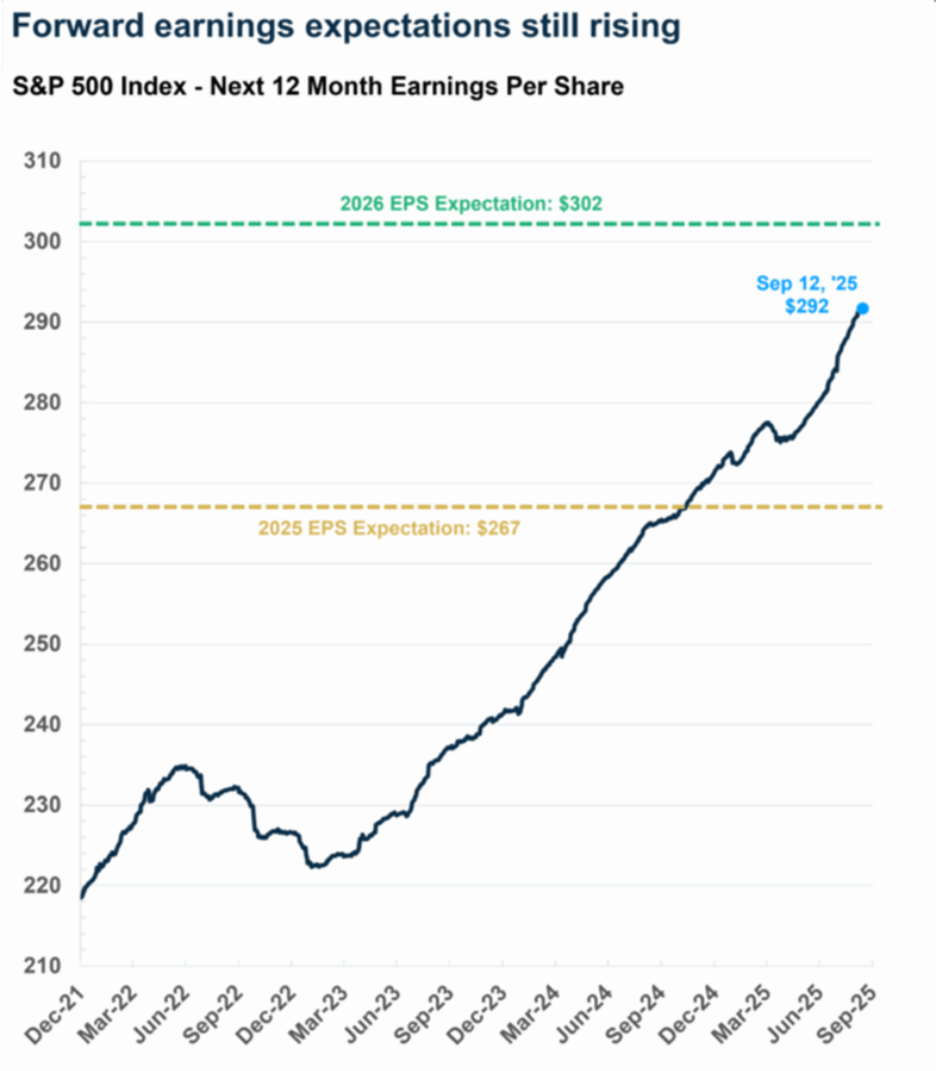

The performance of the S&P 500 Index this year continues to be strongly anchored in the underlying fundamentals of corporate profitability. Through the first three quarters of 2025, the index has delivered a solid total return, significantly supported by profit growth. Earnings per share projections show a positive trajectory, reflecting confidence in continued sales expansion and improved operating efficiencies across American companies, as the first chart highlights. This emphasis on earnings growth, rather than purely valuation multiples, signals a market driven by substantive corporate performance rather than speculative exuberance.

Source: Carson Investment Research, Factset, Data as of 09/12/2025

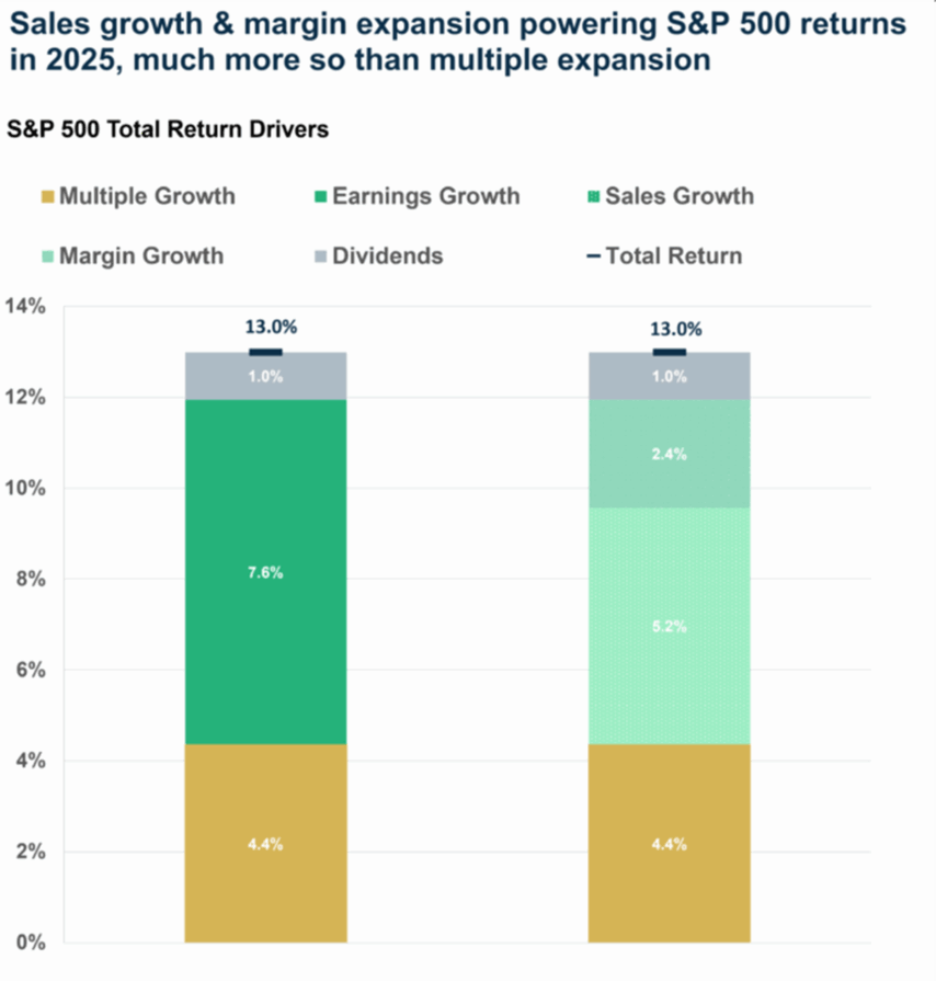

A detailed contribution analysis in the next chart reveals that over half the index’s return this year stems from gains in profits—both retained earnings and dividends—highlighting the importance of sustainable earnings expansion. Sales growth and margin improvement are key components powering this profit growth, with margins recently reaching new highs, underscoring effective cost management, and operating leverage. While valuation multiples have contributed to returns, their role has been secondary compared to the strength of corporate earnings and dividend payouts.

Source: Carson Investment Research, Factset, Data as of 09/12/2025

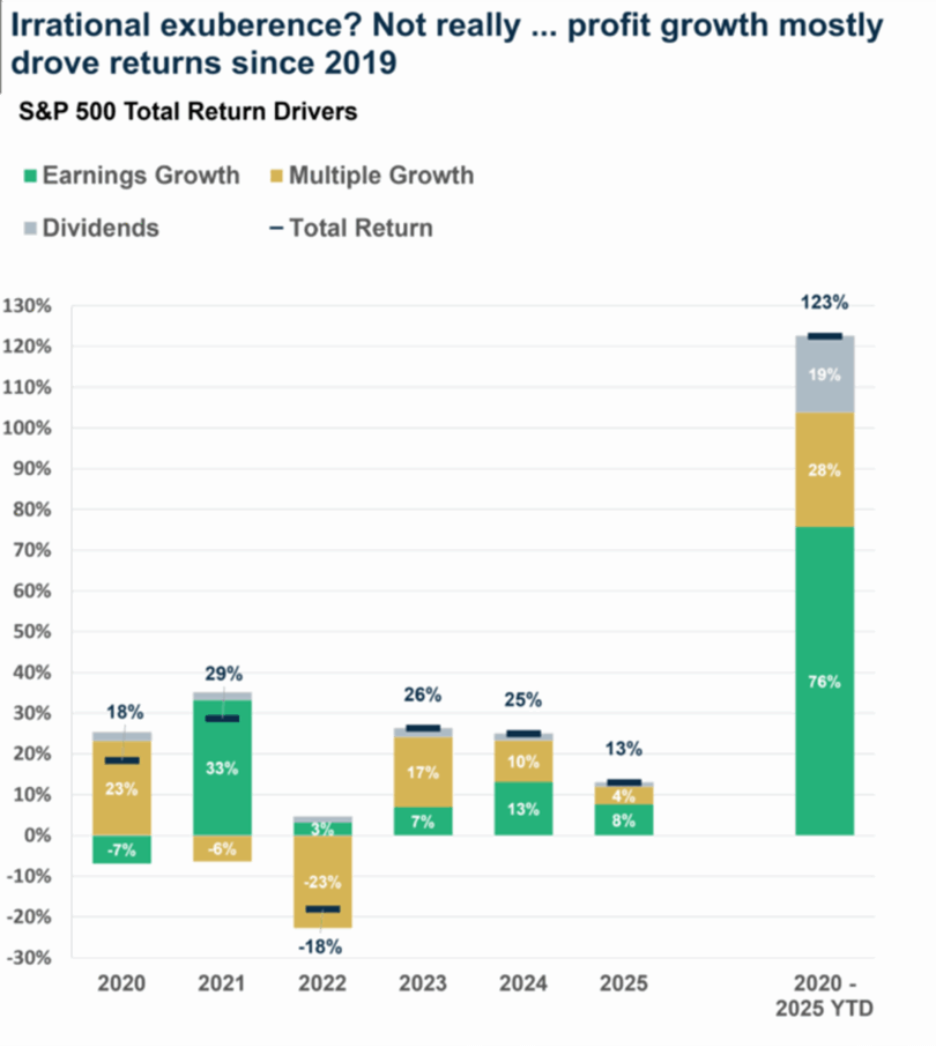

Looking at a broader timeline in the last chart below, the past several years shows a consistent pattern where fundamental earnings growth has been the predominant driver of market gains. This trend spans various economic conditions, including periods of recession and inflationary pressures, illustrating resilient corporate adaptability. Although market valuations may appear elevated compared to historical norms, this is largely justified by expanding profit margins and an accommodative monetary and fiscal environment supportive of ongoing top- and bottom-line growth. The overall picture is that the current equity market appears to reflect a foundation of robust corporate fundamentals rather than just speculative excess.

Source: Carson Investment Research, Factset, Data as of 09/12/2025

Sources: Yahoo Finance, Reuters, The Canadian Press, Carson Investment Research, Factset

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.