Market Insights: Rate Cuts During Positive Markets

Milestone Wealth Management Ltd. - Sep 12, 2025

Macroeconomic and Market Developments:

- North American markets were up this week. In Canada, the S&P/TSX Composite Index closed 0.80% higher. In the U.S., the Dow Jones Industrial Average rose 0.95% and the S&P 500 Index increased 1.59%. Yesterday, all three indices hit all-time closing highs.

- The Canadian dollar was flat this week, closing at 72.22 cents vs 72.22 cents last week.

- Oil prices rose this week, with U.S. West Texas crude closing at US$62.52 vs US$62.04 last week.

- The price of gold rose again this week, closing at another all-time high US$3,683 vs US$3,647 last week.

- The U.S. Consumer Price Index (CPI) in August, rose 0.4% (2.9% YoY), above expectations, with energy (+0.7%), food (+0.5%), and airline fares (+5.9%) leading the increase; core CPI, which excludes food and energy, climbed 0.3% (3.1% YoY) as housing rents, used cars, and vehicle repairs pushed higher while medical care declined, real wages dipped 0.1% on the month (+0.7% YoY), and jobless claims hit their highest since 2021—signs of a labor market treading water—supporting expectations the Fed will trim rates by at least 25 bps next week as policy remains tight despite inflation staying above target.

- The U.S. Producer Price Index (PPI) in August, fell 0.1% (2.6% YoY), well below expectations, with energy -0.4% and food +0.1% while core prices also declined 0.1% (+2.8% YoY); goods prices rose modestly (+0.5% annualized over six months) and services slowed (+1.4% annualized), reinforcing a downward inflation trend that supports the case for the Fed to resume rate cuts next week—meanwhile, benchmark payroll revisions show job growth was overstated by 911,000 over the year ending March 2025, pointing to a weaker labor market backdrop.

- Canadian officials reported “constructive discussions” with China over Beijing’s steep 75.8% preliminary duties on Canadian canola seed, imposed in August, with the Saskatchewan-led delegation raising trade concerns during a Sept. 6–9 visit; while a final ruling is not expected until next year, Ottawa emphasized continued engagement to defend Canada’s C$5B canola exports to China and support producers facing one of the country’s most significant agricultural trade disputes

- The Bank of Canada is expected to cut its overnight rate by 25 bps to 2.50% on Sept. 17, with at least one more cut likely this year, as a weakening labor market (65,500 jobs lost in August; unemployment at a 9-year high outside of pandemic periods) and a sharper-than-expected 1.6% Q2 GDP contraction from U.S. tariffs weighing on the economy; while inflation remains within the 1–3% target band, core inflation is still elevated, ruling out larger cuts, and economists see target rates heading to 2.25% by year-end (currently 2.75%) with fiscal policy and USMCA developments shaping the outlook.

- Internal government briefing materials released this week highlight Canada’s “dire” housing situation, noting costly housing is straining the economy, with vulnerable and middle-class households struggling as rapid population growth outpaces supply, rental costs rise, and construction expenses climb 58% since 2020 amid U.S. tariff pressures; homelessness has surged (shelter use up 43% since 2020), while Canada lags global peers in non-market housing (4% vs. 7% OECD average), prompting Ottawa to launch a new Build Canada Homes agency to accelerate affordable housing and push adoption of new building technologies.

Weekly Diversion:

Check out this video: Mission Impawsible

Charts of the Week:

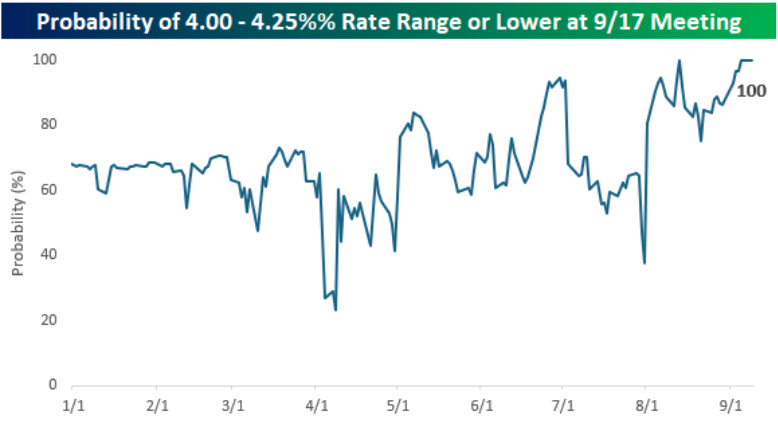

Central banks play a pivotal role in shaping economic trajectories, often deploying policy tools like interest rate reductions to influence growth and stability, and no central bank is more closely watched than the U.S. Federal Reserve (Fed). Notably, the timing of these interventions—especially when rate cuts occur amid strong equity markets—has prompted debate about their underlying rationale and potential impact on financial assets, particularly stock indices. The CME FedWatch Tool currently indicates a 100% chance of at least a 25-basis point rate cut by the Fed, as the first chart highlights. While this week's U.S. Consumer Price Index (CPI) report came in above the majority consensus, it's highly unlikely they'll alter the Powell Fed's decision at this point.

Source: Bespoke Investment Group

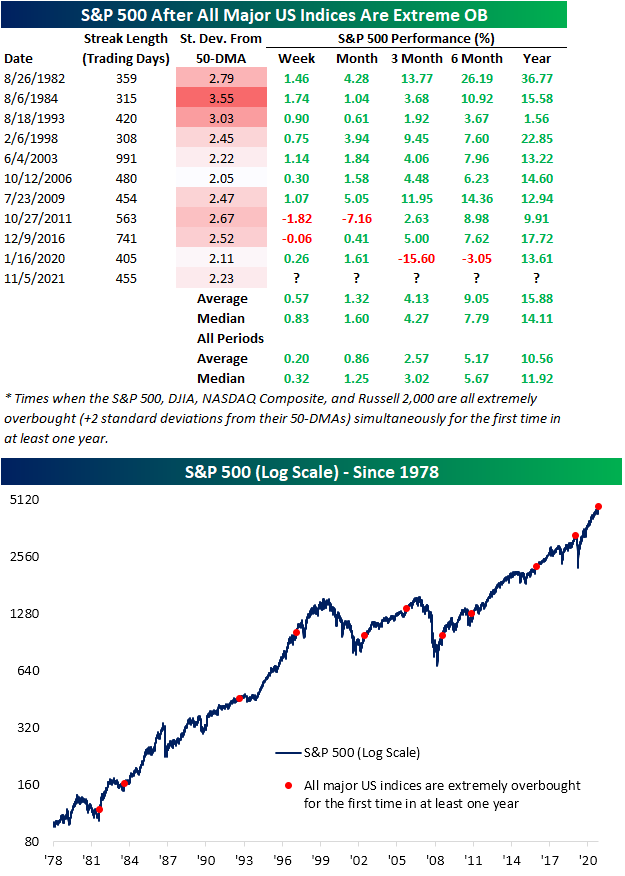

Historically, there have been 37 Fed rate cuts since 1994. Contrary to the belief that rate cuts only follow market distress, several cuts, particularly during Chairman Powell’s tenure and the late 1990s, have occurred when the S&P 500 was within days of a 52-week high, as shown in the next chart. Every rate cut under Powell, for example, happened less than 50 trading days from such a high. This reveals that strong market performance does not necessarily influence the Fed’s decision-making, as monetary policy is oriented toward broad economic conditions, not just stock market trends.

Source: Bespoke Investment Group

Fed rate cuts are usually intended to counteract economic weakness, but the effect on the stock market depends on the context and timing of the cuts. When rate cuts occur near market highs—or when the Fed is not engaging in a series of rapid cuts—subsequent equity performance tends to be positive. This challenges the conventional wisdom of "don’t fight the Fed," suggesting the timing and conditions surrounding rate cuts are crucial to understanding likely market outcomes.

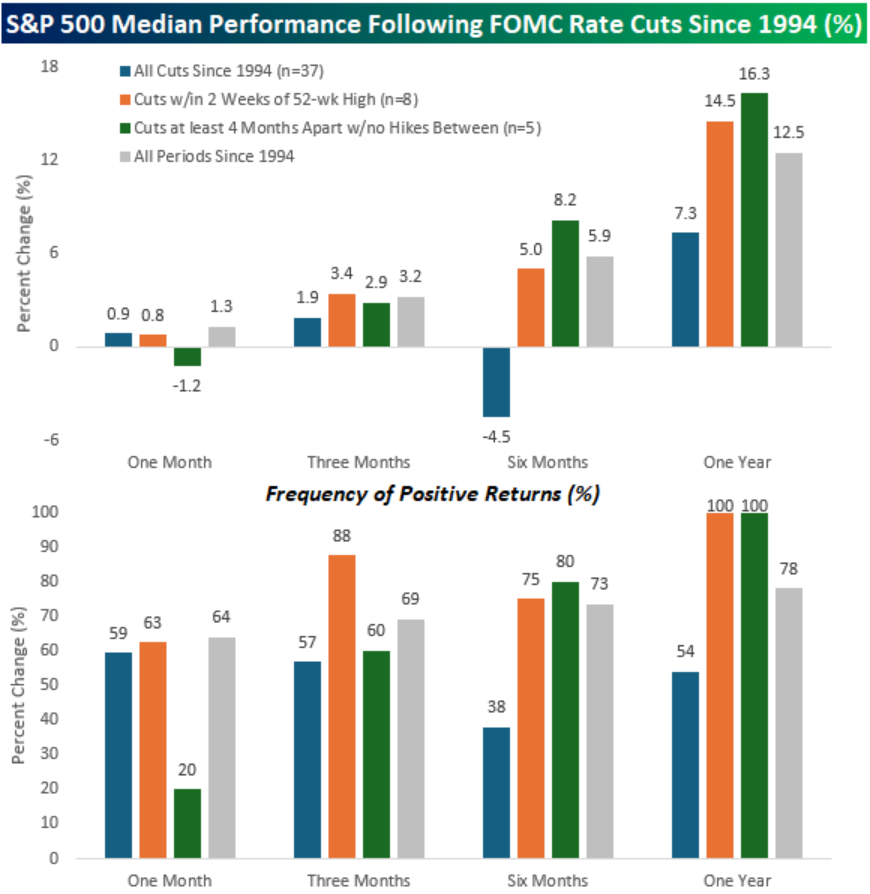

Key points from the last chart below:

- All Rate Cuts: The median one- and three-month returns for the S&P 500 after a cut were modest gains (0.9% and 1.9%). However, six months post-cut, the median return was a 4.5% decline, with positive six-month outcomes occurring just 38% of the time. The picture improves a year after the cut, with a median gain of 7.3%, though this is weaker than typical annual performance since 1994.

- Cuts Near Market Highs: Of the 37 cuts, eight occurred within two weeks of a new 52-week high. This is the likely scenario for next week’s announcement (orange bars below). These instances produced stronger and more consistent positive returns in the following months—every one resulted in a positive gain for the S&P 500 a year later.

- Cuts After Extended Pauses: In rare cases where the Fed cut rates, paused for at least four months, then cut again (without rate hikes in-between), near-term S&P 500 results were weaker. However, six and twelve months later, performance was well ahead of the long-term average. One year after these events, the median gain was 16.3%, with all instances yielding positive results.

Source: Bespoke Investment Group

While rate cuts are often associated with bearish economic signals, the S&P 500’s close proximity to record highs does not necessarily prevent further gains—especially when cuts follow a measured approach or occur without immediate crisis. For investors, this historical view shows that context matters greatly in interpreting monetary policy actions and their likely impact on equity markets.

Sources: Yahoo Finance, Reuters, The Canadian Press, Bespoke Investment Group

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.