Market Insights: U.S. Electricity Outlook

Milestone Wealth Management Ltd. - Aug 22, 2025

Macroeconomic and Market Developments:

- North American markets were up this week. In Canada, the S&P/TSX Composite Index closed 1.53% higher. In the U.S., the Dow Jones Industrial Average also rose 1.53% and the S&P 500 Index inched ahead by 0.27%.

- The Canadian dollar was down just slightly this week, closing at 72.28 cents vs 72.40 cents USD last week, but recovered nicely today, advancing by 0.6%.

- Oil prices were steady this week, with U.S. West Texas crude closing at US$63.79 vs US$63.13 last week.

- The price of gold rose this week, closing at US$3,417 vs US$3,383 last week.

- Canada’s annual inflation slowed to 1.7% in July (from 1.9% in June), helped by a 16.1% drop in gasoline prices alongside the removal of the carbon levy, which is expected to keep fuel costs subdued for months. Core inflation eased, with the three-month average slipping to 2.4%, it’s lowest since September 2024, boosting hopes the Bank of Canada may cut rates as soon as September. Still, food (+3.3%) and shelter costs (+3.0%) climbed, keeping 37% of the CPI basket above 3%. Markets raised the probability of a September rate cut to 40% after the report, while the Canadian dollar weakened modestly.

- Canada saw an unprecedented $8.3 billion outflow in June, capping a $43.7 billion drain in Q2 as foreign investors dumped equities (notably banks and trade/transport) and Canadians snapped up U.S. and global assets. Foreign appetite for Canadian bonds has cooled, with federal debt demand shifting heavily to domestic buyers, raising concerns about Ottawa’s future borrowing needs. National Bank’s Warren Lovely warned that “foreign investor apathy” is at historic levels and said clarity on fiscal policy and trade deals is critical to restoring confidence.

- Prime Minister Mark Carney will announce that Canada is removing most of its retaliatory tariffs on U.S. goods that comply with the USMCA, in a major policy shift aimed at easing tensions with Washington and laying groundwork for the upcoming USMCA review. The move follows a call between Carney and Trump and comes without concessions from the U.S.. However, tariffs on steel, aluminum, and autos will remain.

- The number of Canadians receiving employment insurance (EI) rose 3.4% in June to 541,000, up 11% year-to-date and 12.8% from last year, even as the unemployment rate held at 6.9% in July. The sharpest monthly increases came from sales & service (+5.4%) and manufacturing/utilities (+11%), with job losses concentrated in trade-sensitive sectors such as manufacturing, resources, and transportation. RBC notes permanent layoffs aren’t spiking, but workers are taking longer to find new jobs. EI usage rose across all demographics, with the steepest year-over-year jump among women 55+ (+21.7%).

- President Trump announced that the U.S. government will acquire a 10% equity stake in Intel, calling it part of a broader push to secure America’s chip supply chain. The deal follows Trump’s meeting with CEO Lip-Bu Tan, who has faced pressure over ties to China. Intel, which posted an $18.8B loss in 2024, has struggled with its foundry turnaround but recently secured a $2B investment from SoftBank. Federal backing could provide critical support as Intel looks to rebuild competitiveness. Trump hinted at more government tie-ups ahead, framing them as essential for national security and semiconductor leadership. Intel shares rose 6% on the news.

Weekly Diversion:

Check out this video: You’ve got to see this play

Charts of the Week:

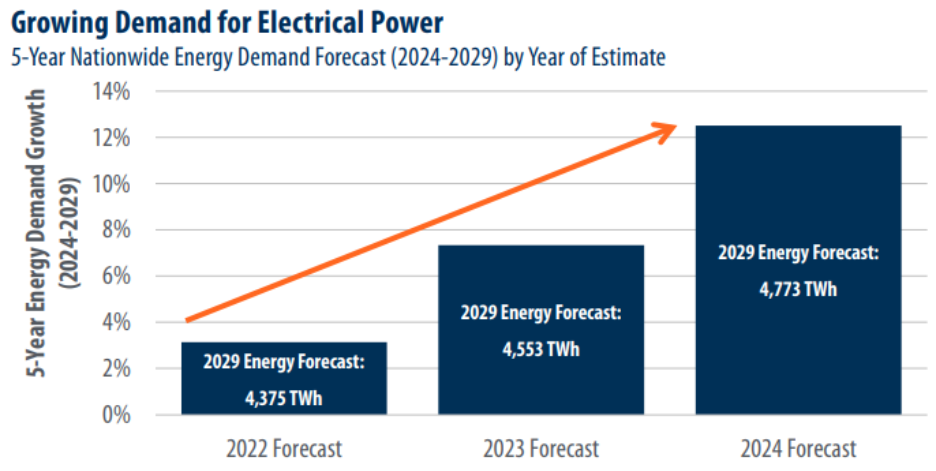

The coming decade is set to reshape the American energy landscape as rising electricity demand intersects with transformative trends in the economy and technology. At the heart of this evolution lies a challenge: ensuring that the nation’s power infrastructure can keep pace with both surging consumption and rapid shifts in how energy is generated.

After years of stable electricity usage, the trend line for U.S. demand has turned decisively upward in recent years. Multiple forces fuel this acceleration. The electrification of transportation, the explosive growth of data centers powered by advancements in artificial intelligence, and a rebound in domestic manufacturing are all acting as tailwinds, pushing the nation's appetite for reliable power to new heights. Projections now signal that power usage will grow at a rate much faster than previously estimated, highlighting the need for agile responses from utilities and policymakers.

Source: GridStrategies, First Trust Advisors, Information published December 2024

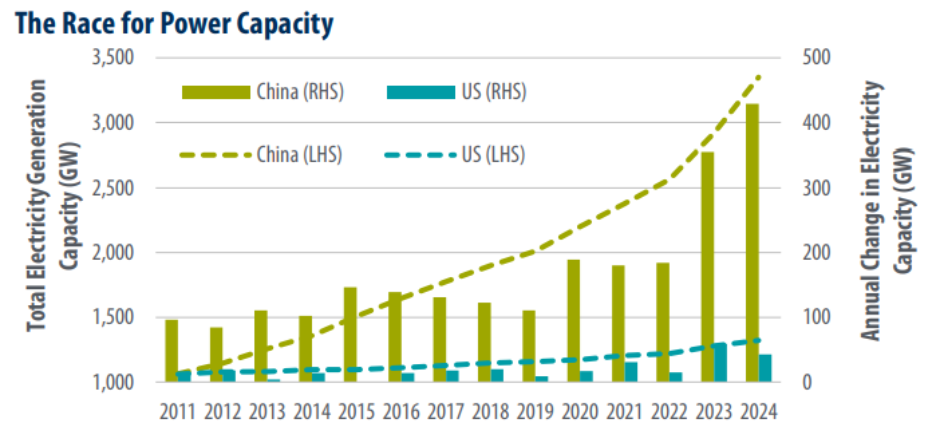

However, the increase in demand comes at a time when the U.S. power grid faces significant headwinds. The expansion of generation capacity—especially the infrastructure required to move electricity from where it is produced to where it is most needed—has not kept up. Investment in new, high-capacity transmission and robust grid modernization has lagged even as the aging infrastructure strains with new demands. Compared to peer nations (see China in the chart below), making massive investments to boost their energy competitiveness, the United States faces the risk of falling behind unless it accelerates its rate of capacity additions.

Source: Ember, National Energy Administration (China), First Trust Advisors, U.S. Estimates published Feb. 2024, China estimates published Jan. 2025

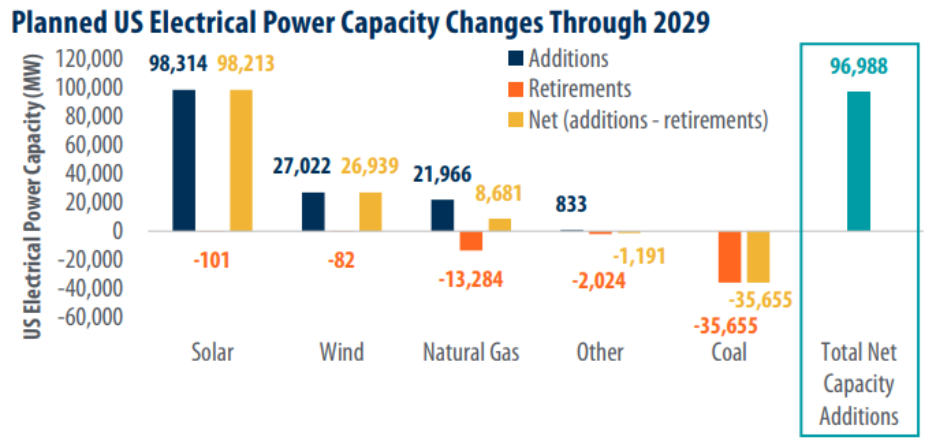

An additional layer of complexity comes from the changing composition of the nation’s electricity generation. Most new generation capacity scheduled to be brought online in the next several years draws from renewable sources, primarily solar. While this transition is critical for sustainability goals and the reduction of carbon emissions, it introduces volatility into the system, as intermittent sources may not always align with peak usage periods. Meanwhile, traditional baseload sources—such as coal—are being retired more quickly than they are replaced, and modest additions to natural gas capacity are not enough to fill the void, as the next chart illustrates. This dynamic raises important questions about how reliability and flexibility will be maintained as the grid evolves.

Source: U.S. Energy Information Administration, First Trust Advisors, Estimates as of Q3 2024

All these intersecting trends—shifting demand, changing generation, and infrastructure challenges—underscore the urgency of strategic investment and policy innovation. The future of American economic competitiveness, security, and environmental stewardship will depend on whether its energy systems can adapt to these heightened demands and shifting technological paradigms. Meeting these goals will require not only deploying more resources but reimagining how power is produced, transmitted, and consumed across the entire economy.

Sources: Yahoo Finance, Reuters, GridStrategies, First Trust Advisors, Ember, National Energy Administration (China), U.S. Energy Information Administration, The Canadian Press, The Financial Post

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.