Market Insights: Understanding Stablecoins and Their Potential

Milestone Wealth Management Ltd. - Aug 01, 2025

Macroeconomic and Market Developments:

- North American markets were down this week. In Canada, the S&P/TSX Composite Index closed 1.72% lower. In the U.S., the Dow Jones Industrial Average fell 2.92% this week & the S&P 500 Index dropped 2.36%.

- The Canadian dollar was relatively stagnant, closing at 72.54 cents vs 72.93 cents last week.

- Oil prices rose this week, with U.S. West Texas crude closing at US$67.35 vs US$65.06 last week.

- The price of gold was up this week, closing at US$3,411 vs US$3,339 last week.

- In the U.S., Q2 2025 Real GDP grew at a 3.0% annual rate, surpassing the consensus forecast of 2.6%, driven primarily by a significant drop in imports boosting net exports, though tempered by inventory depletion. Core GDP (consumer spending, business investment, and home building) rose at a modest 1.2% rate, with nominal GDP up 4.5% year-over-year, signaling tight monetary policy and potential for Federal Reserve (Fed) rate cuts as inflation aligns with the Fed’s 2.0% target.

- U.S. personal income and consumption both rose 0.3% in June, with income slightly exceeding the consensus forecast of 0.2%. However, private-sector wage growth was weak at 0.1%, with government transfer payments (up 1.0%) and public sector wages (up 0.6%) driving income gains. The Personal Consumption Expenditures Price Index (the Fed’s preferred inflation gauge) increased 0.3%, pushing the year-over-year rate higher to 2.6% (2.8% for the core PCE), though inflation is expected to ease as M2 growth remains subdued. Real consumption grew 0.1%, up 2.1% from a year ago, reflecting resilience in consumer spending despite tariff-related price pressures on goods.

- The U.S. Fed maintained steady rates for the fifth consecutive meeting, despite dissent from two governors favoring a 25-basis point cut, marking a rare split since 1993. The Fed acknowledged slower GDP growth (1.2% annualized in H1 2025 vs. 2.5% in 2024) and elevated economic uncertainty, while Chair Powell described the current rate as only moderately restrictive. Despite CPI rising at a 1.8% annualized rate since January, below the Fed’s 2% target, Powell emphasized waiting for more data, while critics argue the Fed is clinging to outdated models and missing signals that cuts are needed now.

- July U.S. nonfarm payrolls rose just 73,000 vs. 104,000 expected, while downward revisions to prior months wiped out 258,000 jobs. The unemployment rate ticked up to 4.2%. Slowing job creation, especially in “core” private sectors, suggests weaker labor momentum. Wage growth cooled to 3.9% YoY, supporting calls for Fed rate cuts in September. Stricter immigration enforcement may be reshaping labor supply, with native-born employment rising even as foreign-born jobs decline. President Trump replaced the Labor Statistics Commissioner Friday, citing data manipulation dating back to the last administration.

- The Bank of Canada (BoC) kept rates steady at 2.75% but left the door open for cuts, citing U.S. trade tensions and weaker growth. Governor Macklem said the BoC couldn't issue a single forecast due to tariff unpredictability and instead outlined three economic scenarios. While core inflation remains elevated, the Bank expects it to ease and flagged that further weakness — especially if tariff impacts stay contained — could justify a cut as early as September.

- President Trump granted Mexico a 90-day extension to finalize a trade deal but lowered expectations for a Canadian deal. Tariffs on Canada were increased from 25% to 35% today on all products not covered by the US-Mexico-Canada trade agreement.

Weekly Diversion:

Check out this video: First Touchdown of the NFL Season

Charts of the Week:

Stablecoins have become a transformative force in the evolving world of digital finance. Their fundamental innovation lies in their design: they are digital assets explicitly structured to maintain a stable value by pegging themselves to traditional assets like the U.S. dollar or commodities such as gold. This objective stability stands in stark contrast to the price volatility typically associated with cryptocurrencies like Bitcoin or Ethereum. The primary mechanism securing this consistency involves holding equivalent reserves—most often in U.S. dollars—with the leading issuers providing full backing for every token in circulation. Alternative models, such as those backed by other cryptocurrencies or managed by algorithms, also exist, but they comprise a small minority of the overall market.

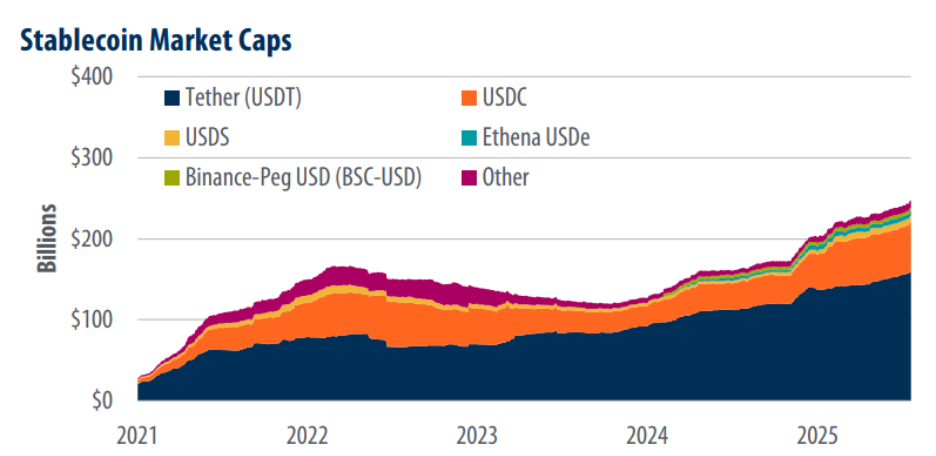

Over the past several years, stablecoins have grown at a remarkable pace. From virtually nonexistent a few years ago, the market has surged to an impressive $250 billion valuation. Two major players dominate the space, with Tether (USDT) and USD Coin (USDC) collectively accounting for over 90% of all stablecoin activity, as shown in the first chart below. Most of these are backed directly by fiat currency, providing users and institutions confidence in their value. This concentration is indicative of trust in these issuers and the perceived stability and reliability of their reserves.

Source: rwa.xyz, First Trust Advisors. Daily data 1/1/2021- 7/20/2025

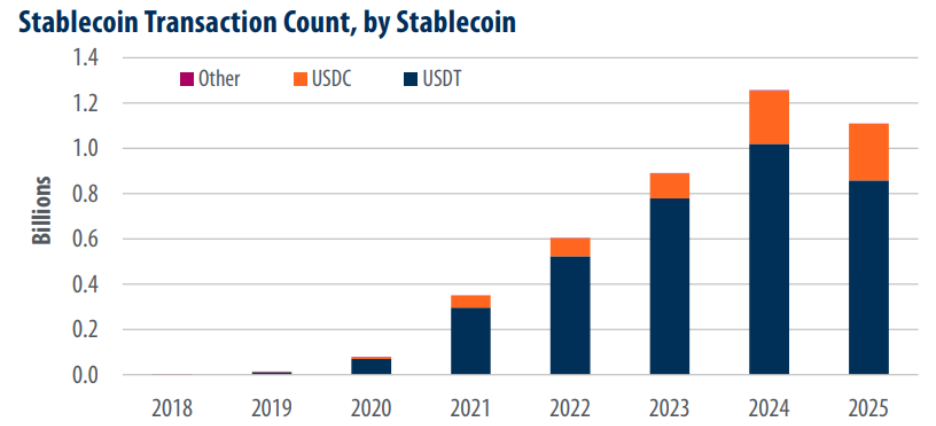

The practical uses of stablecoins are rapidly expanding, having already reached a significant milestone: in just the first seven months of 2025, stablecoins facilitated more than one billion transactions—nearly matching the total activity from all of the previous year, as the next chart highlights. This heavy usage underscores their growing importance as a payment tool, especially for cross-border transactions. Stablecoins have several distinct advantages over traditional international payments, including the ability to operate at any time, lower transaction costs, and instant settlement. Their reliance on blockchain technology also means heightened transparency and traceability for users and regulators alike.

Source: Allium, First Trust Advisors. Annual data 2018-2025. 2025 data through 7/22/25

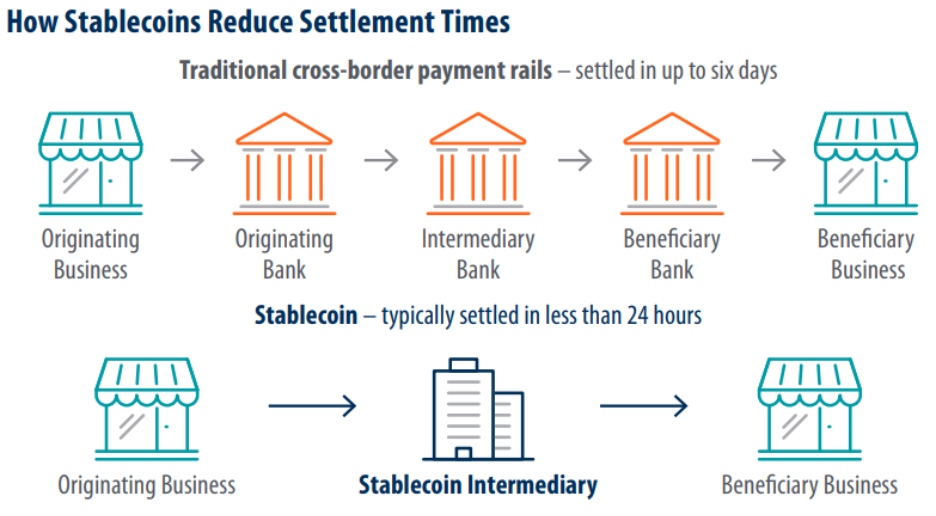

Ultimately, the ongoing adoption of stablecoins signals a broader shift in global finance. For businesses and individuals—particularly in regions with limited access to conventional banking—stablecoins offer a more accessible, efficient, and reliable means of transferring value internationally, as illustrated in the comparison diagram below. As regulation continues to evolve and the infrastructure supporting stablecoins matures, these digital assets are likely to become even more embedded in both everyday commerce and the world’s broader financial systems. Their ascent could potentially reshape how money moves across borders, making financial inclusion and seamless global connectivity a reality for many more people.

Source: CPMI, BVNK, First Trust Advisors

Sources: Yahoo Finance, The Canadian Press, Reuters, First Trust Advisors, Allium, CPMI, BVNK, rwa.xyz

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.