Market Insights: U.S. Federal Taxes: Who’s Carrying the Load?

Milestone Wealth Management Ltd. - Jul 25, 2025

Macroeconomic and Market Developments:

- North American markets were up this week. In Canada, the S&P/TSX Composite Index closed 0.66% higher. In the U.S., the Dow Jones Industrial Average rose 1.26% this week & the S&P 500 Index increased 1.46%.

- The Canadian dollar lost all its mid-week gains, closing at 72.93 cents vs 72.90 cents USD last week.

- Oil prices fell again this week, with U.S. West Texas crude closing at US$65.06 vs US$67.38 last week.

- The price of gold decreased slightly again this week, closing at US$3,339 vs US$3,356 last week.

- Canada reported a C$6.5 billion federal deficit for the first two months of FY 2025/26 — nearly double last year’s C$3.82 billion shortfall — driven by a 4% increase in program spending and rising debt charges. Revenue growth was flat, with weaker corporate tax and GST intake offset by a 180% surge in customs duties due to retaliatory tariffs on U.S. imports.

- In the U.S. June durable goods orders plunged 9.3%, the largest drop since 2020, due to a sharp decline in aircraft orders after May’s Qatar Airways deal. Excluding transportation, orders rose 0.2% with broad gains across sectors. Core capital goods shipments, a key GDP input, rose 0.4% and grew at a 3.1% annualized pace in Q2. Markets now look to the Fed’s September meeting for possible rate cuts.

- Congress passed a landmark bill establishing the first U.S. regulatory framework for stablecoins — digital assets designed to maintain a steady value, typically pegged to the U.S. dollar. The move marks a significant step toward legitimizing stablecoins as a part of the broader financial system. With market caps approaching $300 billion and over 1.1 billion transactions already in 2025, stablecoins like USDT and USDC are becoming essential tools for digital payments. They enable faster, cheaper, and more transparent global transactions — often settling in under 24 hours, compared to the traditional 3 to 6 day bank process — and operate 24/7, making them especially useful for regions with limited banking access or during off-hours.

- Tesla plans to debut its robotaxi service in San Francisco this weekend, per an internal memo. The rollout follows a test run in Austin and will cover much of the Bay Area. Select Tesla owners will be invited first. CEO Elon Musk is fast-tracking self-driving efforts as EV sales slow, though regulatory hurdles remain — California officials say Tesla has not yet applied for the permits needed to operate fully autonomous ride-hailing vehicles. Musk claimed during this week’s earnings call that Tesla is working to obtain approvals in California, Nevada, Arizona, and Florida.

- Nvidia CEO Jensen Huang praised President Trump’s newly announced AI action plan, calling it a “very big deal” that will “fundamentally change” the U.S. position in the global AI race. Huang said the plan will accelerate innovation and deployment by boosting infrastructure and energy investment, elements he sees as critical to maintaining American tech leadership. “Without energy, we will not be a world leader in AI,” he stated, applauding Trump’s pro-energy stance from day one.

Weekly Diversion:

Check out this video: Could You Bear It?

Charts of the Week:

The passage of the One Big Beautiful Bill Act (OBBBA), which makes permanent the tax rate cuts from 2017, has reignited national discussion about whether the wealthiest Americans are paying their "fair share" in federal taxes. Public debate is often inflamed by prominent anecdotes—such as Warren Buffett paying a lower tax rate than his assistant—that suggest the tax system is skewed in favor of the rich. The general public, whether fueled by media or not, seems to have the impression that the wealthy don’t pay their fair share of taxes. However, examining the latest IRS tax data from 2022 tells a somewhat different story, revealing the significantly progressive nature of the federal income tax structure.

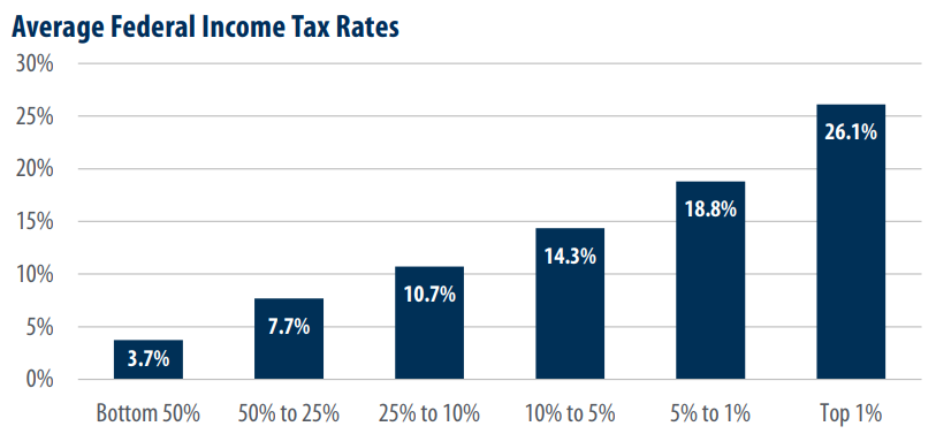

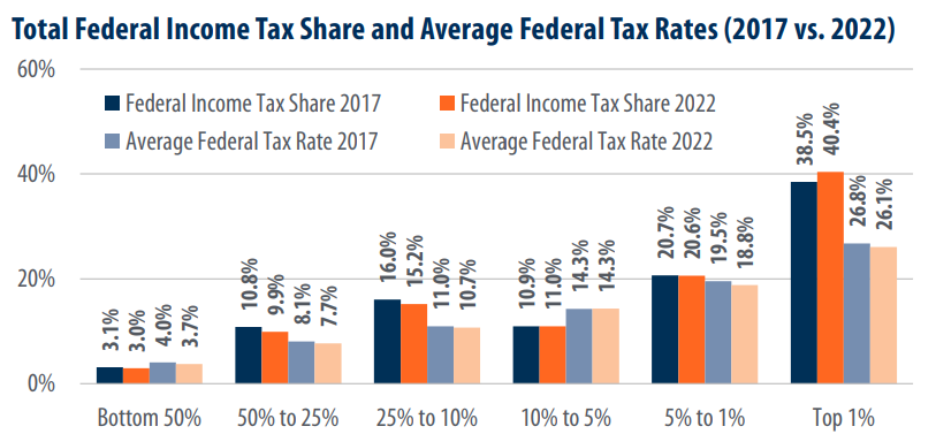

IRS data from 2022 indicates that the top 1% of taxpayers—those earning $663,164 or more—paid an average federal income tax rate of 26.1%, while the bottom 50%—those earning $50,339 or less—paid an average rate of only 3.7%. This means the highest earners pay a rate more than seven times higher than that of the bottom half, as shown in the first chart below. Moreover, the 2017 Tax Cuts and Jobs Act (TCJA) did not solely benefit the wealthy; in reality, average tax rates declined for nearly all income groups between 2017 and 2022, with the exception of the 10th–5th percentile bracket, which remained at 14.3%, as the second chart illustrates. Notably, the share of federal taxes paid by the top 1% increased from 38.5% to 40.4%, while the bottom 50% saw their share decrease slightly from 3.1% to 3.0% in the same period.

Source: IRS, First Trust Advisors. Data for 2022 (latest)

Source: IRS, First Trust Advisors. Data for 2017 and 2022

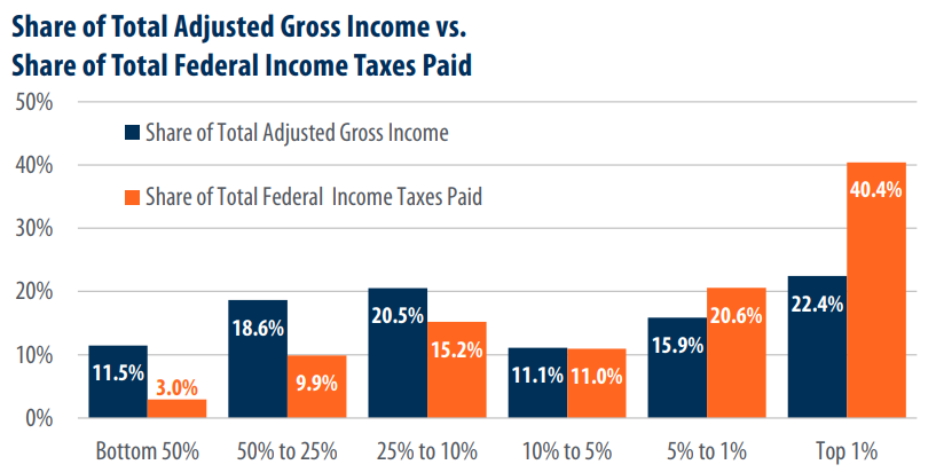

Looking deeper at the overall distribution, the top 1% were responsible for paying 40.4% of the federal income tax burden while earning 22.4% of total adjusted gross income. In contrast, the bottom 50%, despite representing nearly 77 million tax returns and earning 11.5% of total income, paid just 3.0% of the nation’s federal income taxes. Even when considering the bottom 97% of taxpayers—about 149.2 million returns earning 68.0% of total income—they contributed only 46.2% of federal income taxes, not much more than the top 1% alone, as highlighted in the last chart. These figures reinforce that, despite popular narratives, the U.S. federal income tax system remains highly progressive, with the wealthiest Americans shouldering a disproportionately large share of the tax load.

Source: IRS, First Trust Advisors. Data for 2022 (latest)

Sources: Yahoo Finance, Global, First Trust Advisors, Reuters, IRS, Fox Business

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.