Market Insights: Extreme Crude Oil Intraday Declines

Milestone Wealth Management Ltd. - Jun 27, 2025

Macroeconomic and Market Developments:

- North American markets rose this week. In Canada, the S&P/TSX Composite Index closed 0.73% higher. In the U.S., the Dow Jones Industrial Average popped 3.82% and the S&P 500 Index increased 3.44%, closing at a new all-time high while the Dow remains 2.7% below its respective all-time closing high.

- The Canadian dollar inched upwards this week, closing at 72.95 cents vs 72.77 cents USD last week.

- Oil prices dropped drastically after Middle Eastern tensions were resolved, with U.S. West Texas crude closing at US$65.13 vs US$75.00 last week.

- The price of gold fell again this week, closing at US$3,283 vs US$3,380 last week.

- Canada’s GDP shrank by 0.1% in April, with a preliminary estimate pointing to a similar decline in May — signaling economic softness in Q2. Manufacturing led the downturn with a sharp 1.9% drop, especially in auto production, as U.S. tariffs weighed on trade and sentiment. Wholesale trade also fell, particularly in auto-related segments. While financial markets saw a temporary boost from tariff-driven trading, overall momentum remains sluggish. The Bank of Canada has acknowledged tariff pressures and may lean toward further rate cuts if weakness persists.

- President Trump announced the immediate termination of U.S. trade talks with Canada in response to Ottawa’s 3% digital services tax on large tech firms, calling it a “blatant attack” and threatening new tariffs within a week. The move marks a sharp escalation in U.S.-Canada trade tensions ahead of the July 21 deadline to renegotiate the USMCA. Trump also criticized Canada’s existing tariffs on U.S. dairy, calling Canada a “very difficult country to trade with.” Markets reacted swiftly, with the U.S. dollar gaining against the loonie and equity gains paring back.

- Some relief for Canadian investors: At the Trumps administration’s request, U.S. Senators have agreed to remove the contentious ‘Section 899’ from the One Big Beautiful Bill, the tax and spending legislation currently before Congress, citing a new G7 agreement in principle to exempt U.S. companies from OECD Pillar 2 taxes. This ‘Section 899’ had the potential to negatively impact tax planning for Canadian and all Foreign investors investing in the US.

- China officially confirmed the US trade framework, pledging to resume export approvals for controlled items—most notably rare earths—while the U.S. agreed to lift several restrictive measures once exports begin. The agreement, finalized after talks in London and a follow-up call between Presidents Trump and Xi, marks a fragile but stabilizing step in global trade. However, uncertainty remains as tariff threats persist, and export controls are still subject to compliance and enforcement.

- New U.S. single-family home sales fell 13.7% in May to a 623,000 annualized rate—well below expectations—amid rising inventories and affordability headwinds. The months' supply jumped to 9.8, while median prices rose 3% YoY. Despite higher supply, tight existing-home inventory and smaller builds may support sales later in 2025.

- The U.S. Fed’s preferred inflation gauge, the core personal consumption expenditures price Index (PCE), rose to 2.7% in May—slightly above expectations—while headline PCE (including food & energy) held steady at 2.3%. Consumer spending fell 0.1% and personal income dropped 0.4%, signaling slowing momentum in the U.S. economy. While markets are still pricing in a cautious Fed, the uptick in core inflation and Trump’s tariff policies are complicating the case for near-term rate cuts.

Weekly Diversion:

Check out this video: Really Loves his Wife

Charts of the Week:

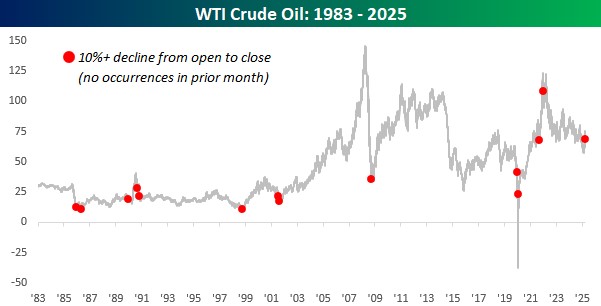

Crude oil experienced a dramatic trading session following U.S. bombings in Iran, initially gapping up 4% on Monday morning. However, as geopolitical tensions appeared to cool rather than escalate, crude oil prices reversed sharply, closing down more than 12% from the opening price and ending the day with an 8.5% decline. This 12.2% intraday drop was the steepest since March 2022 and one of only 14 such 10%+ open-to-close declines since 1983, with no similar occurrences in the preceding month, as shown in the following chart.

Source: Bespoke Investment Group

Double-digit intraday moves in crude oil are rare, even in a commodity known for volatility. These events typically coincide with significant geopolitical or economic shocks, and their rarity underscores their potential to impact not just oil prices but the broader financial markets, including the energy sector and major equity indices.

Market Reactions and Historical Performance

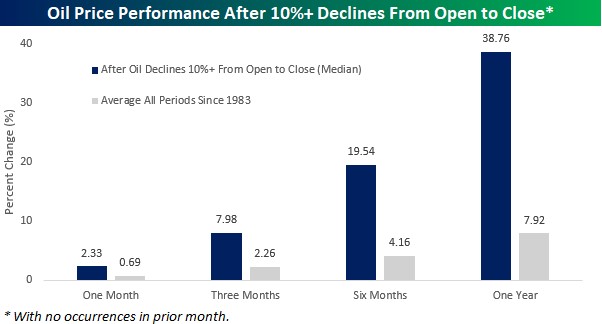

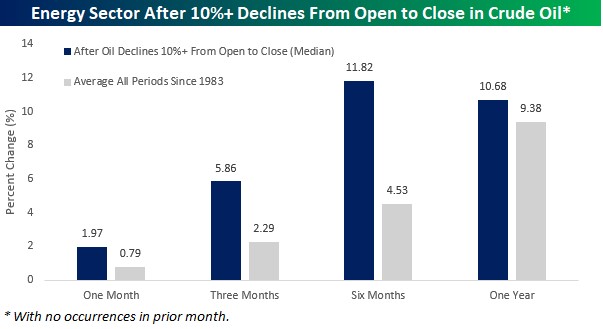

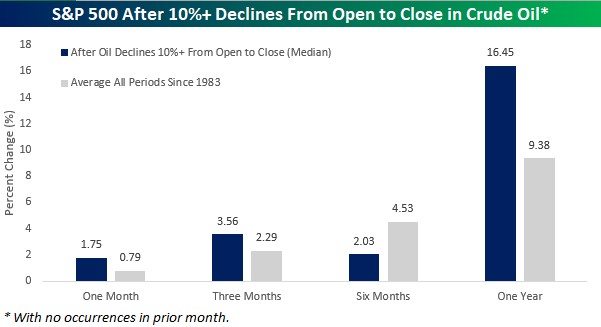

Below is statistical analysis of how crude oil, the energy sector, and the S&P 500 have historically performed after such sharp declines.

- Crude Oil: Following the 13 previous 10%+ intraday declines, crude oil’s median returns over the next three, six, and twelve months were all far better (3.5 to 5 times) than the average for all periods. Notably, six- and twelve-month median gains were 19.5% and 38.8%, respectively, with positive returns occurring 77% of the time after six months and nearly 70% after a year.

Source: Bespoke Investment Group

- Energy Sector: The energy equity sector also tended to outperform after these events. Three months post-decline, the sector’s median gain was 5.9% (more than double the average), with positive returns 85% of the time. Six-month returns were also more than two times stronger than for all periods, though the one-year outperformance was only modestly better.

Source: Bespoke Investment Group

- S&P 500: The broader S&P 500 index showed median returns that were slightly stronger than average for all periods over the next three months and weaker over the next six months. However, the one-year median gain of 16.5% was significantly higher than the historical average. This suggests that while the immediate aftermath may not be extraordinary, the longer-term outlook is general positive for the overall market following such oil price shocks.

Source: Bespoke Investment Group

Intuitively, the results are perhaps not a surprise given that forward returns are often stronger after a big correction, and that lower energy prices tend to help companies in other sectors by lowering their costs.

A double-digit intraday decline in crude oil, while unsettling, has historically been followed by above-average returns in oil itself and the energy sector, with broader equity markets also tending to perform well over the following year. This pattern may reflect the market’s ability to digest shocks and the tendency for extreme moves to occur near capitulation points or market lows, setting the stage for recovery.

Sources: Yahoo Finance, CBC, First Trust, CNBC, Bespoke Investment Group, Bloomberg, Barchart, Fox Business

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.