Market Insights: Down Days and Average Opening Gaps

Milestone Wealth Management Ltd. - Jun 20, 2025

Macroeconomic and Market Developments:

- North American markets were down this week. In Canada, the S&P/TSX Composite Index inched lower by 0.03%. In the U.S., the Dow Jones Industrial Average was down 1.77% & the S&P 500 Index fell 1.28%.

- The Canadian dollar declined this week, closing at 72.77 cents vs 73.59 cents USD last week.

- Oil prices rose again amid Middle Eastern tensions, with U.S. West Texas crude closing at US$75.00 vs US$73.60 last week.

- The price of gold dropped this week, closing at US$3,380 vs US$3,450 last week.

- U.S. retail sales fell 0.9% in May (vs. -0.6% expected), the sharpest drop since March 2023, as consumers pulled back amid the post tariff surge and geopolitical tensions; however, core control group sales (used in GDP calculations) rose 0.4%, suggesting selective consumer spending remains resilient despite headline weakness.

- Canadian retail sales rose 0.3% in April to $70.1B, driven by a 1.9% gain at motor vehicle and parts dealers, including a 2.9% boost in new car sales. Core retail sales, which exclude gas and autos, edged up 0.1%, while overall sales volumes rose 0.5%. However, preliminary data suggests a 1.1% decline in May, signaling potential softness ahead. Gains were seen in sporting goods and electronics, while clothing and accessories sales fell 2.2%.

- Keyera to acquire Plains All American’s Canadian NGL business for $5.15B, marking its largest deal ever. The acquisition includes 2,400+ km of pipeline infrastructure with 575,000 barrels/day capacity, along with assets across Eastern and Western Canada. CEO Curtis Setoguchi emphasized the move keeps infrastructure and income in Canadian hands. The deal increases Keyera’s enterprise value by up to 46%, while Plains will focus more on its U.S. crude oil operations, using proceeds for buybacks and acquisitions.

- The Los Angeles Lakers are being sold in a record-setting $10 billion deal to billionaire Mark Walter, ending the Buss family’s 47-year control. Jeanie Buss will remain as team governor, while Walter—already a minority owner and Dodgers executive—takes the reins. The sale sets a new high for a U.S. sports franchise and marks a major shift for one of the NBA’s most storied teams.

- IBM is currently the best-performing stock in the Dow for 2025, marking the first time since at least 1993 it has led at the halfway point of the year; while it hasn’t ended a full year as the Dow’s top performer since 1996, history shows that the first-half leader goes on to finish the year in first place just over 30% of the time.

Weekly Diversion:

Check out this video: My Tail Would Not be Wagging

Charts of the Week:

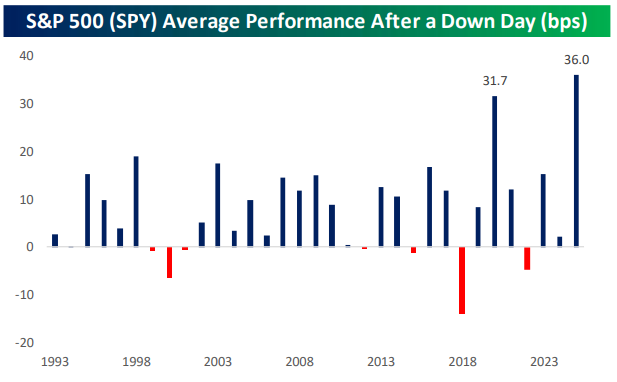

The performance of the S&P 500 ETF (SPY) from open to close, especially following days of market decline, reveals unique dynamics so far in 2025. According to recent data highlighted in the next chart, the average gain on the day after a down day has reached 36 basis points through June 12, marking the highest such performance since the ETF’s inception in 1993. This surge even surpasses the notable "buy the dip" activity seen in 2020, when stimulus checks fueled widespread retail investment.

Source: Bespoke Investment Group

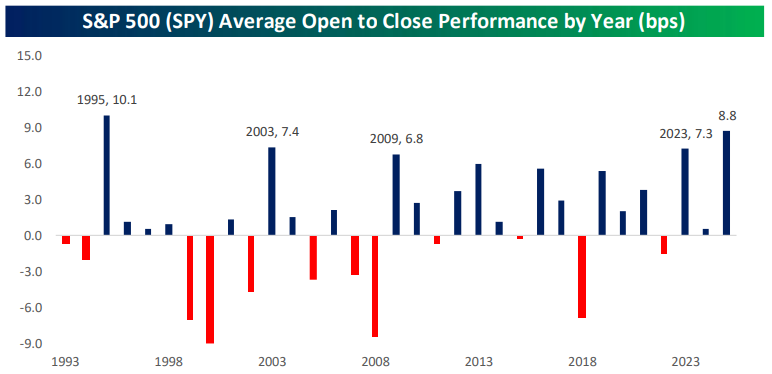

Interestingly, this year’s average opening price gap ranks among the weakest since 1993, placing it alongside some of the market’s most challenging periods. Despite these weak openings, the average gain from the open to close stands at 8.8 basis points, one of the strongest on record, as shown in the chart below. Only 1995 saw a higher average, with other standout years being 2003, 2009, and 2023 – all of which were excellent for equities, with the SPY ETF posting returns of 34.4%, 25.2%, 23.2%, and 23.7% respectively.

Source: Bespoke Investment Group

This contrast – poor openings followed by strong intraday recoveries – highlights a market environment where investors are eager to buy on weakness, quickly stepping in after initial declines. The opposing pressures at the open and during the trading session create a confusing landscape for market participants, as the market’s tone shifts dramatically within the same day. Ultimately, while we had a large correction earlier this year, this current pattern underscores the resilience and adaptability of investors in the face of uncertain market conditions.

Sources: Yahoo Finance, The Canadian Press, First Trust, CNBC, Bespoke Investment Group, The Financial Post, Barchart

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.